Few platforms provide more utility to more people than Robinhood. For me, their easy-to-digest platform with simple access to leverage appealed to me as a new investor. Now, as an experienced day trader, I appreciate its feeless trading and mobile portfolio management. Real-time portfolio widgets and notifications keep me engaging multiple times a day.

By embracing the ‘free-to-play/freemium’ business model, Robinhood has successfully captured its current new-to-finance millennial target market but has a significant opportunity to capture educational and professional services. Entering here opens up a $175 billion market potential, all while playing to Robinhood’s strengths of building intuitive and ‘gamified’ UI’s.

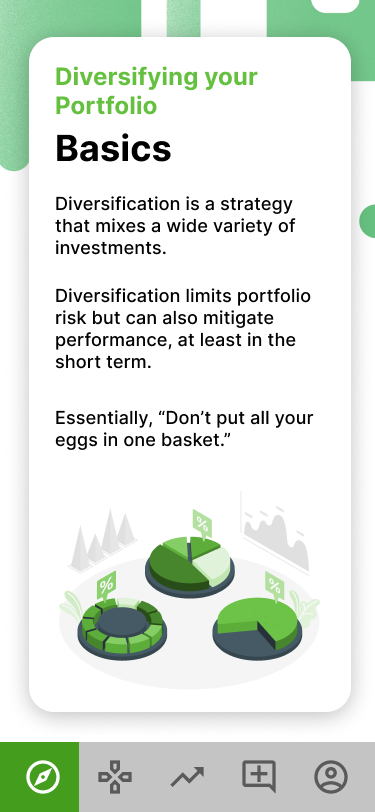

Building out a solution like the above would alleviate one of Robinhood’s glaring faults – its lack of educational material for much of its new-to-investing clientele. By giving access to educational materials and simulators, new investors can get acquainted with and pulled into the Robinhood ecosystem, increasing LTV.

A simulator such as the one to the right affords investors to test new knowledge and strategies. In the short run, this builds confidence in the decisions they were making with their Robinhood portfolio. In the long run, I believe seasoned investors would be more likely to ditch financial advisors in lieu of adding to their Robinhood balance. Whether you want to really get to know investing or just compete with friends for fun, this ‘gamified’ simulator appeals to the general public, especially to their target audience who will want to keep checking back for their leaderboard performance.

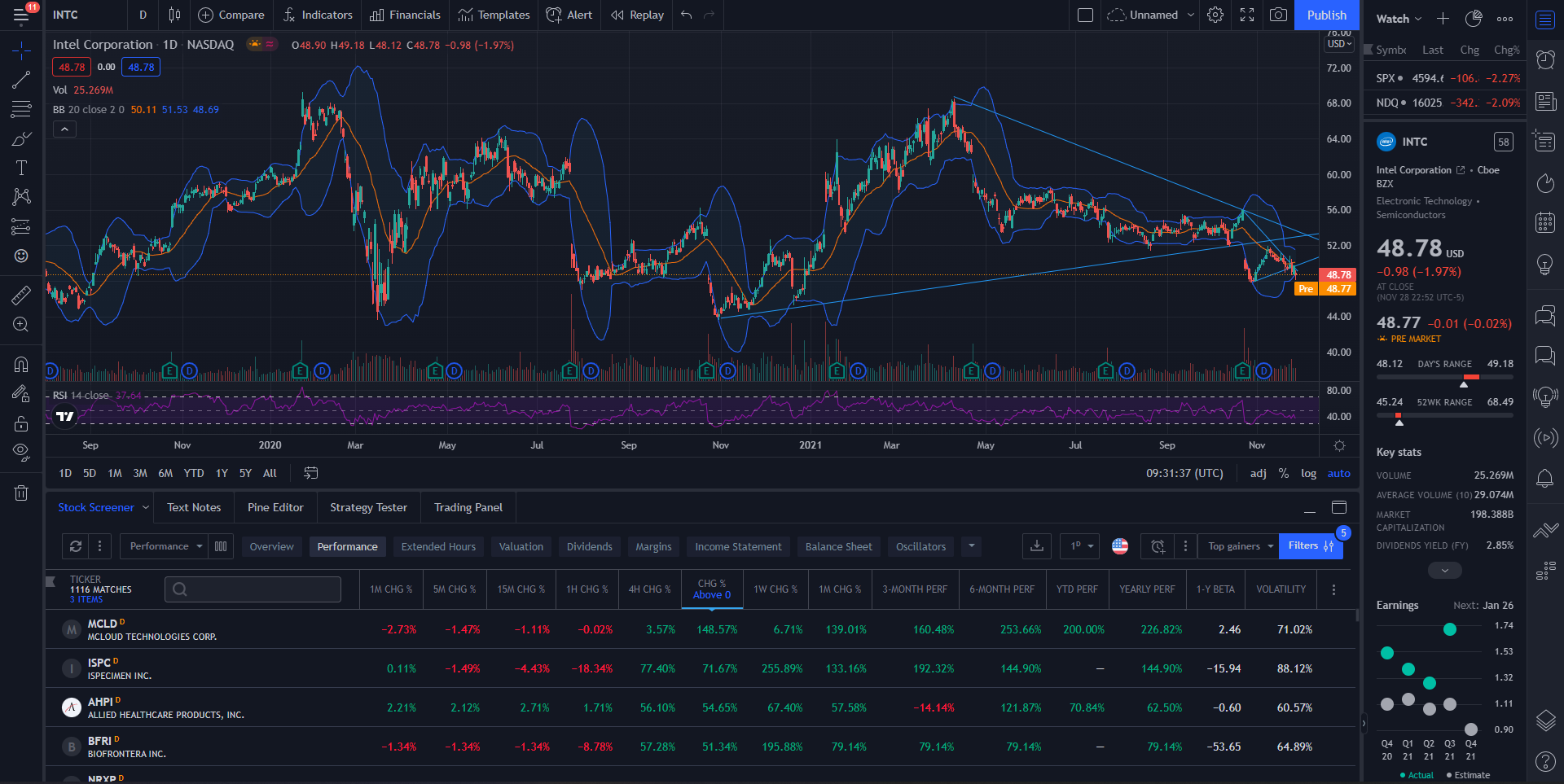

For the investors who want to take their investing and day-trading prowess to the next level, I suggest Robinhood builds out Robinhood Pro. As a day-trader myself, I know many other professional traders would clamor for a combination of sleek, modern daily-use charting and brokerage platforms. While I made the previous mockups, I don’t think any company does day-trading charting better than TradingView. They keep a modern UI similar to what Robinhood does already. While a lot more is happening on the screen, unlike the traditional Robinhood aesthetic, having this as an option for users greatly enhances its usability as a one-stop-shop investing system. In addition, such a change would no doubt require significant R&D – new interfaces (similar to gold standard TradingView), becoming a direct-access broker (meaning focusing on lowering transaction times) to compete with rivals in that space, and advertising to the new market. However, once complete, they could easily undercut competitors’ fees with their 22 million-strong user base.